Regulatory Consolidation

By Steve Gens | July 2023

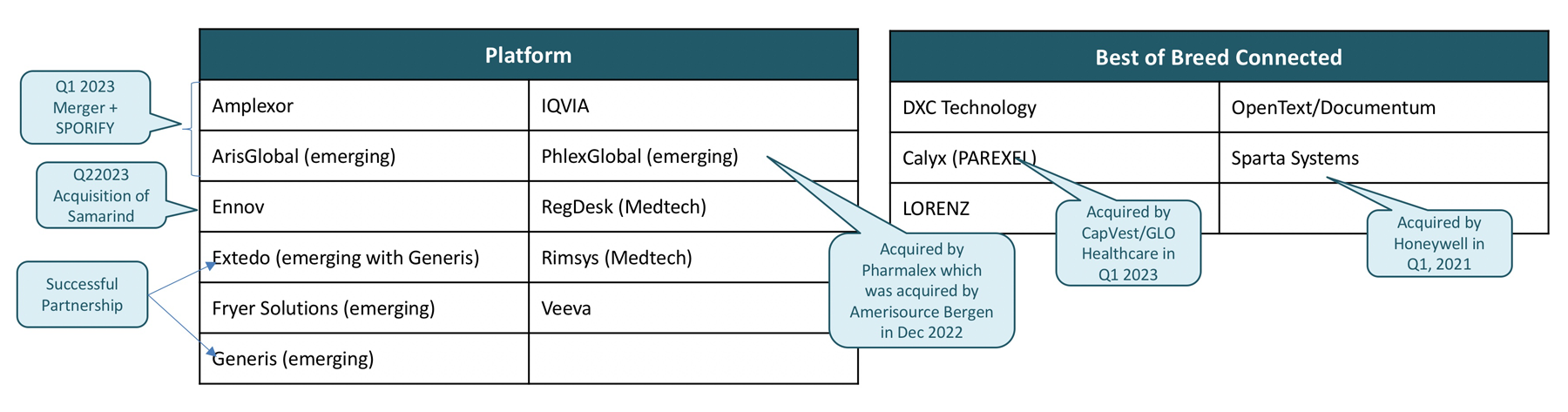

It’s been an interesting 12 months to say the least with ArisGlobal buying both Amplexor and SPORIFY, Ennov buying Samarind, Calyx divestiture from PARAEXEL only to be acquired by CapVest/GLO Healthcare in Q1 2023, and Honeywell buying Sparta Systems. We also witnessed some successful partnerships, especially the combined Generis/Extedo capabilities in both systems and services.

So, what does this all mean and why this pace of “consolidation”? Simply put, it’s the result of 7 + years of significant system and process modernization (relaying the regulatory foundation) where “end to end” thinking, Cloud/SaaS adoption, data quality & connectivity, and simplification were the driving forces.

The regulatory system landscape has greatly changed during these years resulting in many providers shifting their position in these different system strategy categories:

- Platform Providers – This cohort has most of the individual regulatory processes (we call them RIM capabilities) in their platform. While most claim to have a credible publishing and label compliance tracking capability, we believe they are several years away from a mature capability that could compete with the traditional best of breed providers. This is also true with Regulatory Intelligence in which no provider has a mature or innovative solution to date.

- Emerging Platform Providers – This cohort has a traditional “best of breed” base in either the content or data side of RIM and are in the process of expanding their solution to encompass most RIM capabilities organically or via a strategic partnership.

- Best of Breed Connected – This cohort has strengths in a much smaller subset of what we consider E2E RIM and have been impacted (positively or negatively) by the projected E2E RIM adoption trend (55% today and forecasted to peak around 75% in 2025).

I recently discussed this topic with industry veteran John Cogan via a 20-minute information packed podcast moderated by Katherine Yang-Iott (Regulatory Software Provider Consolidation Impact with Steve Gens and John Cogan).

Here are five key insights that I believe you will find interesting:

- 1) The rapid shift to business process “end to end thinking” from a cross-functional lens (e.g., number of departments involved with a change control initiated by a customer complaint) and geographic point of view (e.g., increased local affiliate / central office bi-direction collaboration).

- 2) Executive technology and business leaders wanting to simplify both the business process and system landscape enterprise-wide leading to the question: “How many functions can my software partner support?” This requirement is eliminating most traditional best of breed software providers from the growing number of “strategic” RFPs, especially in the large and mid-tier markets. On the other end of the spectrum, the very small and small tiers are more focused on a partner that can quickly scale at the right price point.

- 3) While we have witnessed the dramatic change to the transactional system layer from “best of breed” to a “platform” approach (Veeva and to a lesser degree Aris/Amplexor, Ennov, and Generis / Extedo), there is still many “tech” players supporting Structured Content Authoring, Natural Language Generation, Robotic Process Automation, and AI. The key strategy question is “how far will the transactional providers play in the value-added tools space”? Stay tuned on this!

- 4) Many “best of breed” software provider market share and customer satisfaction levels have eroded (perhaps because of the E2E SaaS shift) and we expect accelerated erosion as the platform providers’ label management and publishing capabilities become mature (couple of years out). The only exceptions to this are LORENZ and Extedo where their market share has increased driven by industry leaving other publishing providers and a pick-up in global health authority customers – they have successfully diversified their business.

- 5) It’s interesting that the software providers that have supported this space over the past 20 years (Generis, LORENZ, Extedo, etc.) AND have not been acquired, are faring very well. But is it time for these players to make big investments to accelerate their strategies?

Finally, our public World Class RIM study whitepapers provide a deeper analysis of these points while our membership have access to our comprehensive and detailed regulatory software and services market reports that are updated several times a year.