Regulatory Transformational Change an Industry-Wide Phenomenon – Gens Survey

By Steve Gens

As we continue the analysis from the 2016 Gens and Associates World Class Regulatory Information Management (WCRIM) survey of 54 companies, there are some key findings that provide interesting insights on industry trends and what companies want to achieve with their regulatory information management (RIM) solutions and processes.

In my last blog, I spoke to you about how we’ve established a baseline for world-class RIM and what we’re hearing from our survey participant debrief discussions is that the measures and method used to determine the world class baseline are resonating. This helps to reinforce the definitions we’ve developed and ultimately will enable companies to compare their strategies and work towards world-class or simply “what is good performance”.

A key trend we’re observing is the vast majority of companies are now seeking to achieve clear and measurable business benefits from their RIM strategies beyond effective regulatory compliance. That’s leading to massive change across the industry with 88% of survey participants undertaking or planning to undertake some type of transformational change in different parts of their RIM program. Specifically, these is a high focus on dramatically improving the dossier management and the submission forecasting / planning capability, product registration data quality, advanced reporting and analytics, as well as labeling (content control and compliance tracking of label changes).

Widespread change is also expected around Identification of Medicinal Products (IDMP), Master Data Management (MDM), and for medical device companies, Unique Device Identification, with 60% saying they will be instituting some transformational change in these areas.

Focused Push for Efficiency and Productivity

What’s particularly noteworthy is the reason why so much change is taking place. Historically, the focus was largely on achieving effective compliance. More recently, however, companies have begun to question the efficiency of their compliance solutions and whether their people can be more productive with better RIM global capabilities (central, regional, and local affiliate). The average efficiency for the 17 RIM components we track is only 40% which is very low, but moderately better than the 2014 average. Some areas have acceptable efficiency levels such as submission product and document management. Consequently, companies want to address those deficiencies and so they’re looking at what changes they need to implement to gain efficiency and productivity from improved systems, standardized processes, and better organization roles and decision rights.

The effects of transformational change will be felt at the provider level, and again we’re seeing some interesting trends with regards to the degree of buying decisions and industry views on innovation. As a result of those changes I outlined earlier, we’re expecting to see a lot of life sciences companies switch their vendor software over the next two or three years in several key areas. Specifically, around two-thirds of respondents are planning changes to their submission forecasting and planning capability; three quarters are going to change the way they manage health authority correspondence; and surprisingly, half are still changing their product registration management capability over the next two years.

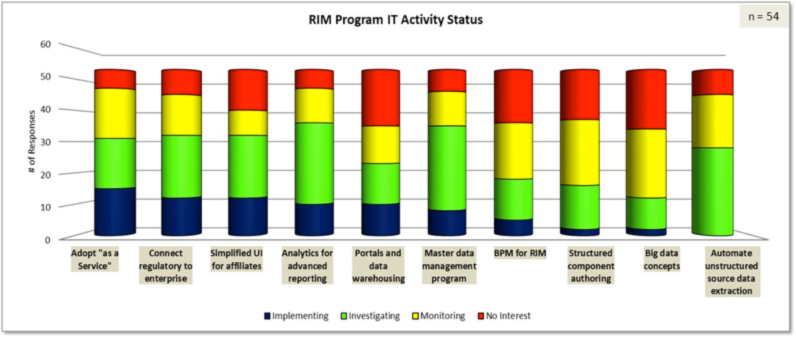

We also updated our innovation index of 25 RIM providers that was baselined during our 2014 survey. In other words, who is innovating, who is keeping up with industry, and where are we seeing a decline. A few innovator companies are really pushing the envelope with emerging technologies, by which I mean advanced analytics and reporting, business process management, MDM, cutting edge technologies to automate unstructured source data extraction from documents, and better visualization tools. You can see in the figure below the high degree of focus (combining the blue and green) for SaaS, connecting regulatory to other critical touchpoints (supply release, manufacturing change etc.), analytics, MDM, and automation of source data extraction. We have been getting regular updates from some of the emerging RIM providers and are excited about their progress. We will also detail our emerging technology provider “watch list” in our late July public whitepaper.