Regulatory Outsourcing Drivers Shift to Efficiency, Cost Control, and Talent Supply: Gens Survey

By Steve Gens

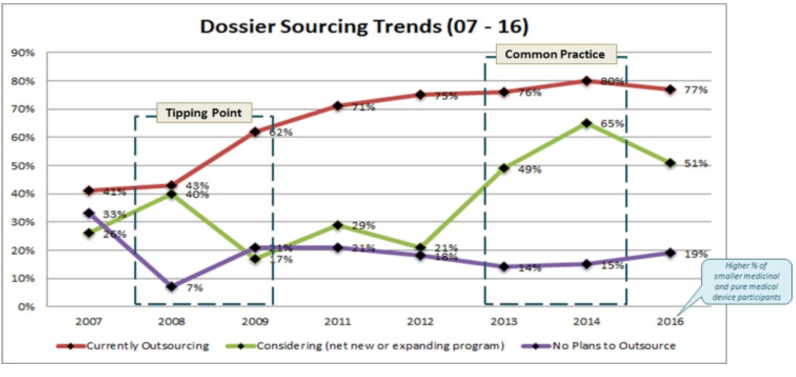

Over the past decade, outsourcing has become an intrinsic part of how life sciences companies operate. Since we began tracking outsourcing in 2007, we’ve seen constant growth to the point that in our 2014 survey analyses we declared that outsourcing is no longer a growing trend, but in fact common practice.

The 2016 Gens & Associates survey, Pursuing World Class Regulatory Information Management (RIM); Strategy, Measures and Priorities (n = 54), finds that outsourcing in many areas has reached critical mass and is starting to level off, but companies are starting to trial outsourcing some aspects of the business that previously were handled in-house.

Perhaps most significant are the drivers for outsourcing are evolving. In the latest survey, 82% of surveyed companies cited increased efficiency of operations as a primary driver to outsource, an increase from 54% in 2014. The overall cost of the operation was another important driver in the 2016 survey, cited by 78% compared with 36% in 2014.

Another factor that is significant – and certainly very important for smaller and mid-tier organisations – is having a stable supply of publishing and regulatory operations talent. In 2014, only 31% referenced talent supply as a driver and in 2016, 69% considered this a priority. Undoubtedly the number one driver for outsourcing remains the same: having the organisational flexibility to manage the peaks and valleys of submission publishing, at 86%.

What are Companies Outsourcing?

In the past, the investigational or new market application tended to be published internally, but today that is the largest area being outsourced. These are some of the most critical dossiers for companies and the fact that they are being outsourced by so many companies indicates the comfort level with service providers.

There are also a couple of very interesting and emerging outsourcing developments: legacy products and Extended EudraVigilance Medicinal Product Dictionary (XEVMPD)/ Identification of Medicinal Products (IDMP).

Five of the 54 companies surveyed – four mid-tier and one large pharma company – are experimenting with outsourcing their legacy products. From a resource point of view, that involves not only regulatory operations, but also global regulatory affairs and safety. Our take on this trend is that these companies recognise the opportunity to use a third-party organisation that can manage their legacy products for them more efficiently and cost effectively, allowing them to retain those products and that revenue stream while focusing their regulatory and safety staff on new product development.

The second emerging trends is that a small percentage of companies now turn to a third party manage their XEVMPD data for them. As the industry transitions from XEVMP to IDMP, our expectation is that this will be another area where companies will look to third parties to provide the skills, expertise, and domain knowledge to manage those critical data, again freeing up internal staff for more strategic activities.

Finally, there was a slight decline in the percentage of surveyed companies outsourcing – from 80% down to 77%. We attribute this to the wider mix of companies taking part in the 2016 survey. Specifically, the inclusion of several pure medical device companies and a larger number of very small medicinal companies pushed the overall percentage slightly down because such companies either tend not to outsource or don’t have the capability to do so as yet.

In future surveys, we’ll be keeping a close eye on these trends and drivers across the broader mix of companies.