2022 World Class RIM Study Results: Initial Steps and Questions

By Katherine Yang-Iott

If you’re part of our benchmark community, you are most likely aware of our process. However, for those that are new to the research community, the intense data analysis period goes from an all-hands-on-deck QC process to building a massive database and cross-checking calculations, then to spirited debates, the provocation of ideas, and finally, either a confirmation or reevaluation of our hypothesis as we progress towards our findings and insights.

To set the stage, the G&A Core Research Team and contributors gathered for a 2 day think tank in Princeton, NJ last week. Each member shared their own interpretations of the data, but we are always interested to see if others see what we see. Greg Brolund examines the data with his technology expert lens, while Kelly Hnat pours her wisdom of structured data submissions into the study. Sara Powell, gives us her deep knowledge on the status of Regulatory Outsourcing and I layer on critical organizational factors that impact performance in a variety of ways. This year, Steve Gens made an additional effort to include interviews with regulatory software providers to make the study’s Software Provider Landscape section even more comprehensive. Even as the core research team were gathered together in person at Princeton, we were also able to extend our discussions and bounce ideas off colleagues in London and Copenhagen.

So what did we see and what is the data telling us? For starters, the RIM Modernization journey started around 2013 and we think we might be at the tail end of that cycle. While the preliminary data reveals the general continued signs of progress in RIM efficiency, data quality and business benefits, the big question is, “what’s next?” after the modernization cycle. We expect to see changes to the 16 RIM capabilities we track, but what advanced technologies, shifts in: organization strategy, E2E process priorities, and regulatory service and software provider landscape can be expected for the short and long term? We’ll have those questions clearly answered in a few weeks.

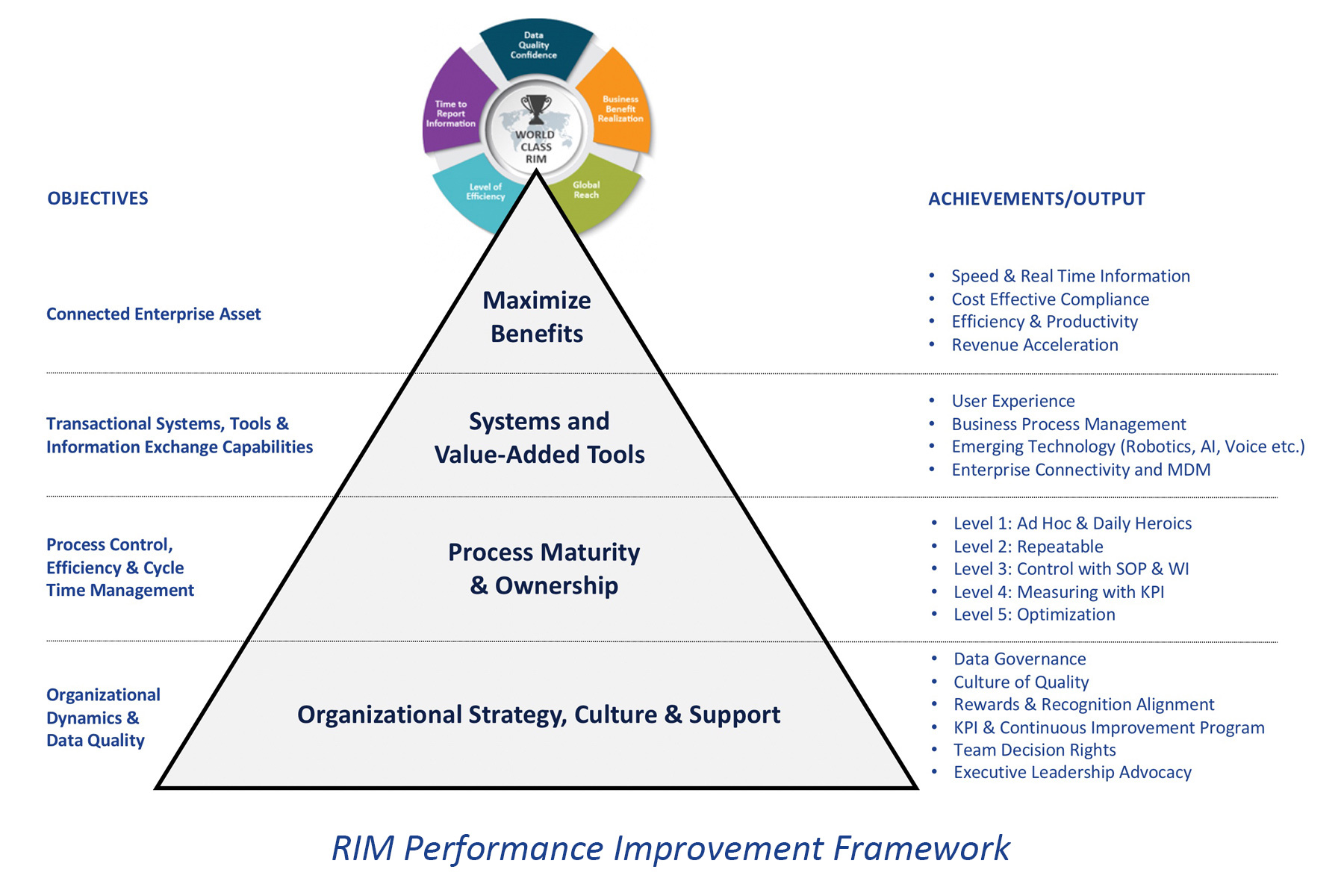

We developed our RIM performance improvement framework as a result of the 2020 study, based off of conversations and subsequent interviews with top performing companies that participated in the research. To follow up on our findings, we included new questions this time to explore these organizational characteristics and the potential impact they have on overall performance. What’s interesting is the correlation between specific cultural aspects and organizational practices, how putting one into practice often generates an operational benefit. For example, we see how companies that have established change management frameworks are more often tied to increased effectiveness in plan implementation and execution. As straight forward as that may seem, we were surprised by how few companies actually have established change management frameworks.

In true G&A fashion, the core research team looked at each data interpretation from multiple angles, which led us to create a new peer comparison scatter chart. This version is broken out by product complexity (the number of marketed products per company) rather than the traditional tier size by revenue. As we like to say, “the data is the data”, however, a different perspective is always a great way to learn something new. One of the delights of producing primary research is the ability to look at the raw data in so many interesting ways.