Nearing the end of the Regulatory

Modernization cycle

By Steve Gens MSOD

We have conducted 38 studies to date with most being focused in the regulatory and adjacent domains. With each study, I find something very significant that I wasn’t expecting or maybe a “hunch” that something is shifting, and it becomes quite apparent in the data. As we closed the 2022 World Class RIM: Accelerating Business Value database of 76 companies and started the analysis in early May, I quickly found that learning nugget and leaned back in my chair and thought, this is very significant!

We debated the title of the survey at the end of last year between World Class RIM, “Accelerating Business Value” or “What’s Next”, as we knew we could answer both questions. We have been closely tracking what has changed, what is currently changing, and what is projected to be changed in the near (within 2 years) and longer term (3 – 4 years) for around a decade.

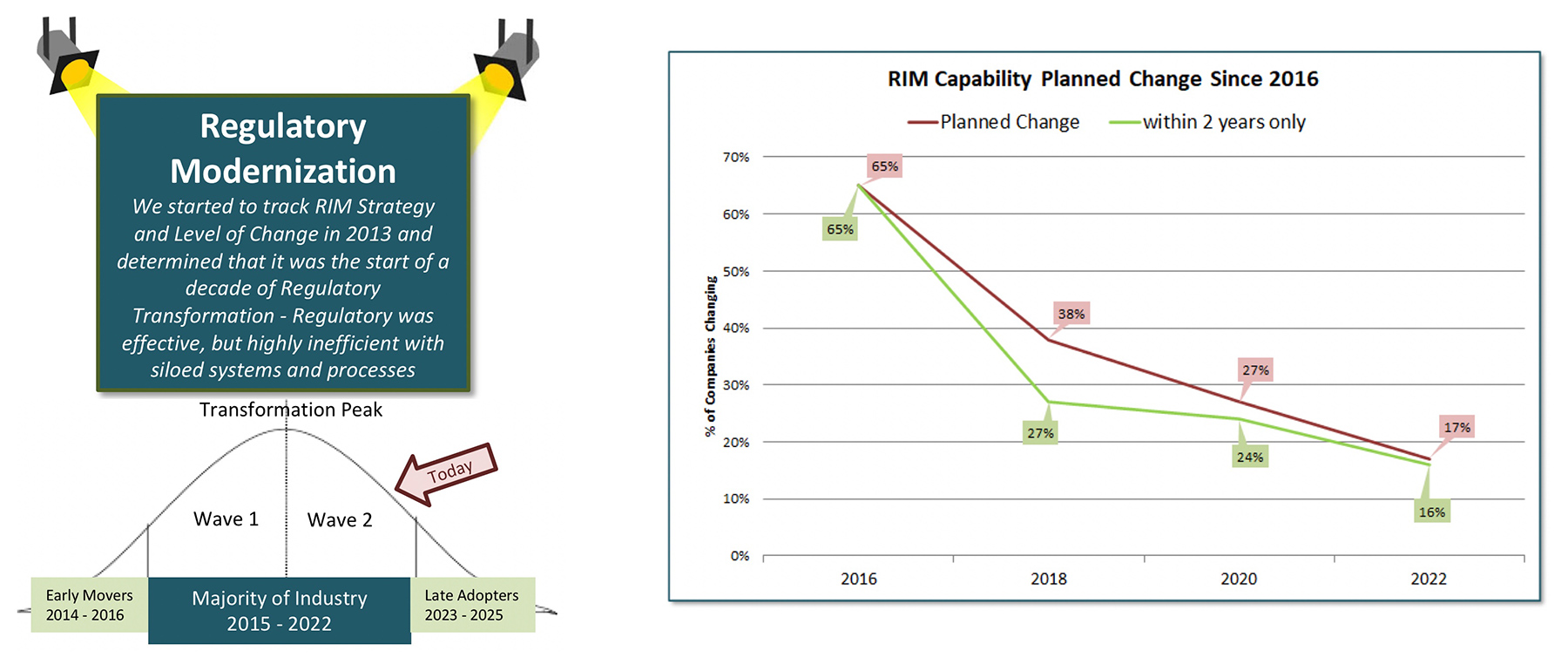

Different Life Science functions go through modernization cycles that tend to take between 7 – 12 years. We saw major modernization in Manufacturing in the 1990’s, e-clinical and sales force automation in the 2000’s and we declared in 2013 “the decade of regulatory transformation” or modernization (which ever term you prefer).

You can clearly see in the figure and data graph below our tracking with the significant reduction of “projected change” in 2022 (meaning work to be done in 2023/24) compared to 2016 and 2018.

Starting in the 2011 – 2013 timeframe, there were many early adopters finalizing their modernization strategy and starting execution while the majority of industry was doing their 3 – 5-year RIM Strategy with business cases in the 2013 – 2016 timeframe with the bulk of execution being evident in the 2016 – 2022 period

We introduced the concept of “end to end RIM” in our 2014 study and formalize the E2E RIM term in our 2015 World Class RIM work. We know there were multiple factors that drove this modernization wave:

- Regulatory solutions were built from a central or headquarters paradigm and did not consider a true global construct with the affiliate (typically infrequent users) and 3rd party partners in the equation.

- The vast majority of the software providers had “nice solutions” and not a platform (the closest was Liquent, they just didn’t have the EDMS dimension at that time).

- It was clear in the 2014 study software provider data that innovation was lacking and industry was innovating faster than the software providers and it had become a big issue!

- 2016 saw the introduction of the regulatory software platform by multiple providers and starting in the 2018 timeframe, we witnessed maturing of these early platform in 3 of the software providers.

So, the big question for the majority of industry is “what’s next”? In our weekly blog series this summer, we will touch on many of these “what’s next” topics:

- Organizational change (roles, structure, remit) as more focus is on cross-functional data connections (data sciences impact) driven by E2E process work (e.g. change control) and IDMP/SPOR automation aspirations.

- Advanced technology experimentation (RPS, AI, NLP, SCA, etc.) and data connection foundation building (MDM, Reference Data Management).

- Cross-functional data connectivity leading to critical investments of data governance practices to bring data quality levels to “high confidence”.

- Strategic initiatives in dossier management (reduce secondary market submission time), e-labeling, and continued investment and improvement in business excellence / continuous improvement programs driven by operational and strategic metrics.